Equipment and Machinery Loan

A machinery loan or equipment loan is a type of secured loan that allows businesses to purchase or upgrade machinery, equipment, or tools. The equipment being financed typically serves as collateral for the loan. Machinery loans are particularly useful for MSMEs that may not have the necessary funds to purchase expensive machinery outright but need the equipment to increase productivity and improve their competitive edge.

What are the risks of taking a Machinery Loan / Equipment Loan?

When considering an Equipment or Machinery loan, borrowers should be aware of common risks such as depreciation of the machinery, obsolescence, maintenance expenses, and the possibility of default. Prior to borrowing, it is crucial to assess the value and usefulness of the equipment to make an informed decision.

What are the benefits of taking an Equipment or Machinery Loan?

Taking a Machinery Loan/Equipment Loan offers multiple benefits. It saves you money on repairs, grants you full ownership of necessary equipment at the end of the loan repayment, enhances production efficiency, and reduces defects and wastage in your production. Moreover, these loans often have lower interest rates compared to Unsecured Business Loans, resulting in long-term cost savings for your business.

Can I get a Machinery Loan without Collateral?

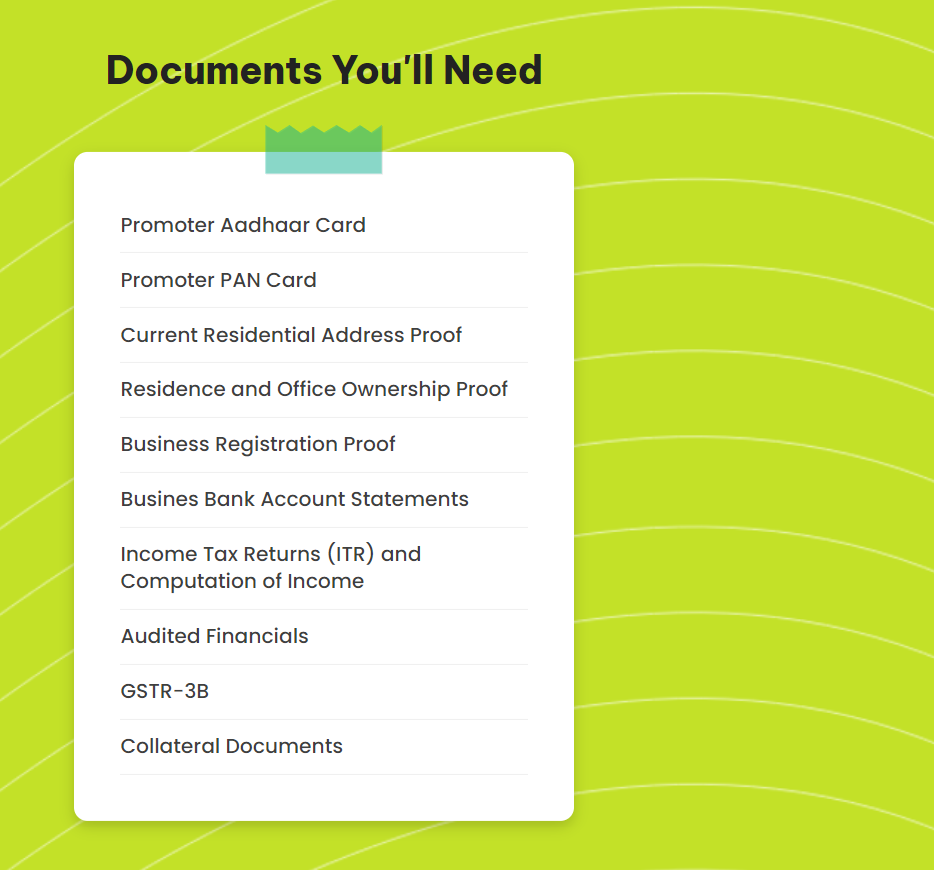

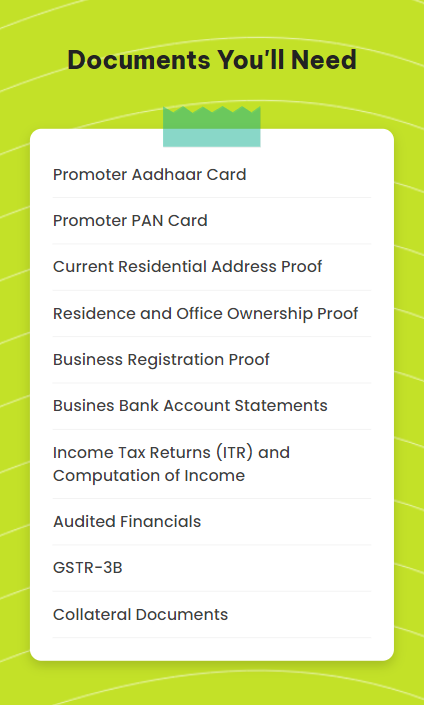

Getting a machinery loan without collateral is possible through lenders who offer Unsecured Business Loans. However, the terms may vary based your creditworthiness and the lender’s risk assessment. Collateral-free Machinery Loans typically have higher interest rates and may require stronger credit profiles. Some lenders may even accept the machinery you want to buy with the loan as collateral for the loan.

Machine loans are an attractive option for Micro, Small, and Medium Enterprises (MSMEs) because they allow them to get the funding they need quickly and easily. This can be especially helpful when you need immediate cash to ensure your business continues operating smoothly and efficiently.

Machinery loan as per your business needs –

Machinery and equipment are the fundamental building blocks of any industry, manufacturing or service. From heavy machinery to basic equipment, these tools are essential to the productivity of any business. When you have good machinery and equipment, you can produce more goods in less time, which means you can sell more goods at a lower cost. That will allow you to make more money and bring in more revenue for your company.

Hence it is essential to invest in good machinery and equipment to perform the required function well without any hindrance. If you’re looking to purchase machinery and equipment, you know that it can be very expensive. That’s why we offer a machine loan!

If you’re in the market for a new machine, or even if you’re just looking to expand an existing one, we can help. We can offer loans for all kinds of machinery and equipment—from manufacturing plants to food processing equipment. But what exactly is a machine loan or equipment financing?